00:18:39

K-Beauty Stocks: Correction Phase or Buying Opportunity?

Key insights at a glance:

- APR stock surged 300% YTD before recent correction

- Summer seasonality impacts cosmetics sales despite tourism growth

- ODM leaders Cosmax and Kolmar Korea maintain R&D edge over Chinese competitors

- European/Middle Eastern exports grew 28-40% YoY (August data)

- 2 million foreign tourists expected to boost domestic K-Beauty sales

The K-Beauty sector faces a pivotal moment as stock prices correct after explosive growth. While giants like APR and Dalba Global saw stocks multiply earlier this year, August brought widespread declines across beauty stocks. We analyze whether this signals market saturation or a strategic buying window.

Market Dynamics & Correction Drivers

Performance Peaks and Pullbacks

Leading K-Beauty stocks demonstrated extraordinary growth in early 2023:

- APR (cosmetics/medical devices): 300% surge (₩51,000 → ₩217,000)

- Dalba Global (premium skincare): 109% growth (₩110,000 → ₩230,000)

- Pharma Research (medical devices): 250% increase (₩200,000 → ₩700,000)

The August correction stemmed from four key factors:

- Valuation pressures after rapid price appreciation

- Profit-taking by early investors

- Missed high expectations (e.g., Dalba's record earnings still fell short of analyst forecasts)

- Seasonal demand weakness - summer humidity reduces makeup/cream usage

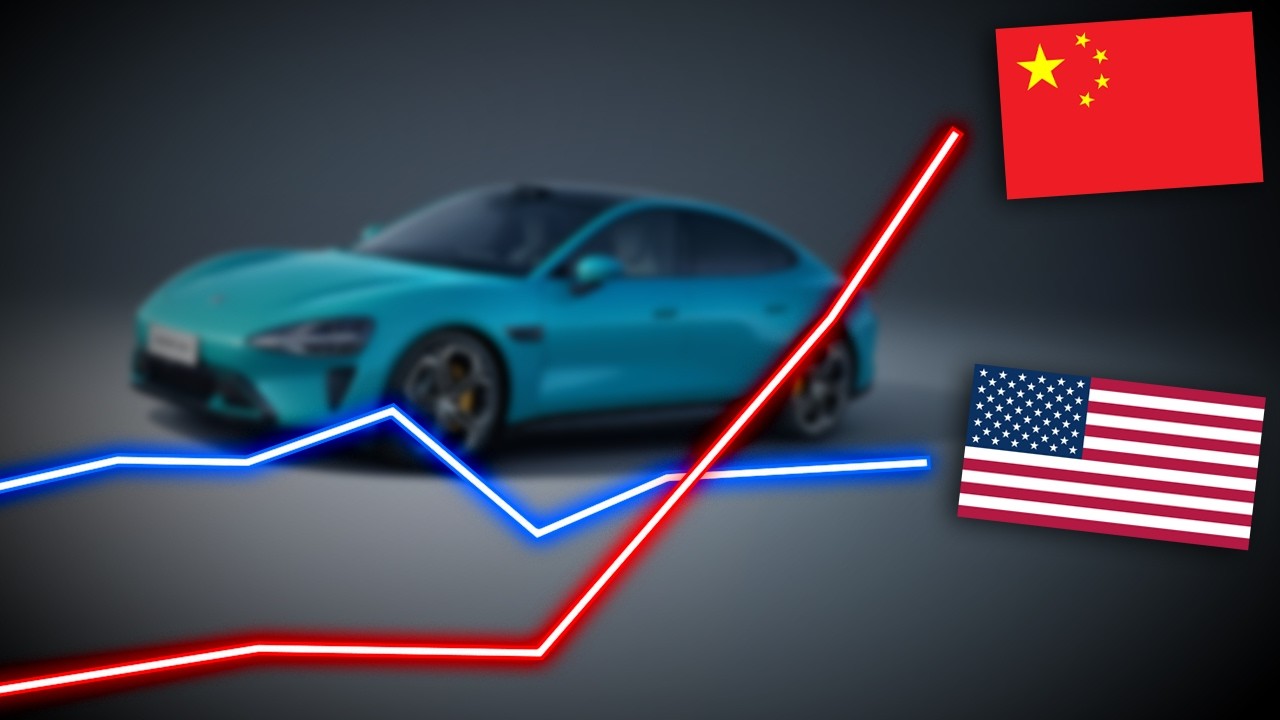

Tariff Impacts and Market Diversification

The 15% U.S. import tariff hit K-Beauty exporters hard, with August export values declining. However, companies are successfully diversifying:

Export Growth (August YoY):

- Middle East: +40%

- Europe: +28%

New Market Strategies:

- APR's European subsidiary development

- Dalba's offline retail expansion

Growth Catalysts Ahead

Tourism and Seasonal Demand

With China's visa-free policy resuming, Korea anticipates 2 million+ tourists in 2023. Historical spending patterns suggest significant domestic beauty sales impact:

Projected tourist contribution (7-day visit):

₩140-280 billion (assuming ₩10-20k daily spending)

Peak season begins in Q4 due to:

- Winter skincare needs (heavy moisturizers)

- Major shopping events (Black Friday, Singles' Day)

- Medical tourism growth (e.g., Pharma Research's Lizuran treatments)

ODM Powerhouses: Sustainable Advantage?

Korean original design manufacturers (ODMs) maintain dominance through:

Cosmax

- Produces for L'Oréal, Clio, Dr.Jart+

- 60-70% YTD stock growth

- 1,000+ Chinese client base

Kolmar Korea

- R&D-driven formulations

- Rapid production turnaround

- Cost efficiency from scale

Despite Chinese competition, industry experts note Korean ODMs retain 20-year technology leads in specialized formulations and quality control.

Strategic Challenges

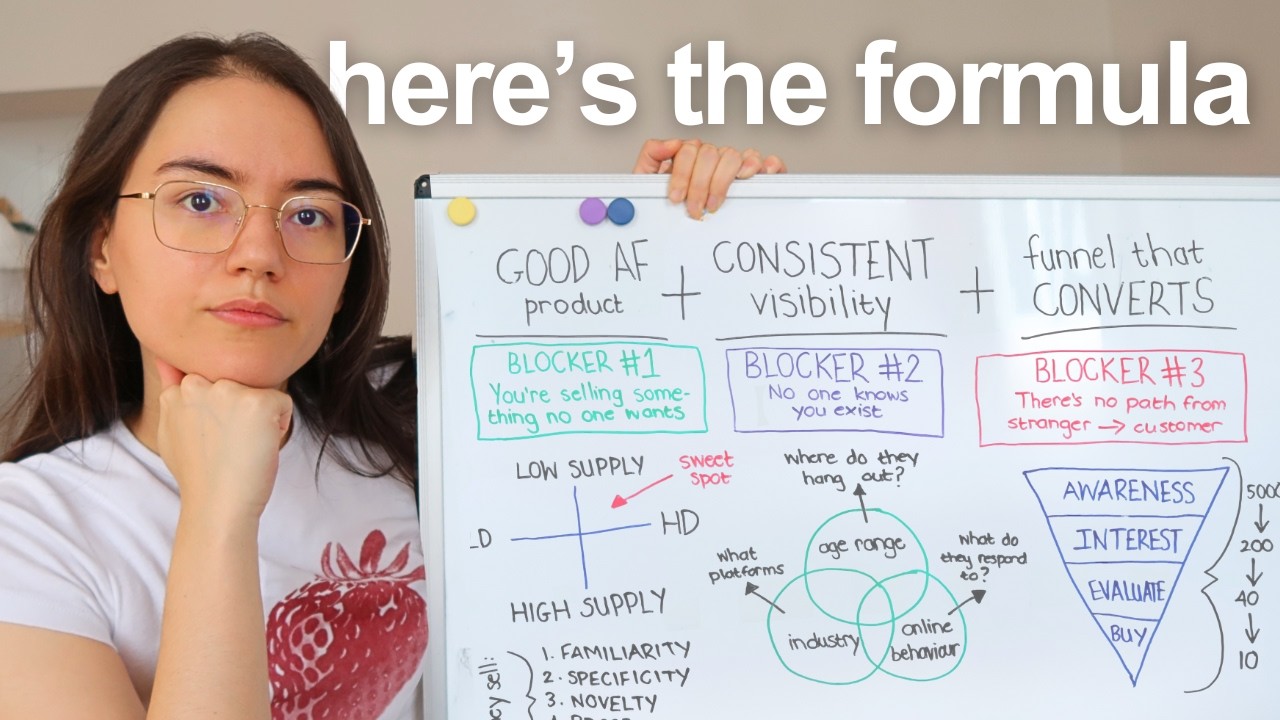

Premiumization vs. Chinese Competition

C-Beauty's rise challenges K-Beauty's historical price advantage. Chinese brands like Florasis now enter Korean markets, leveraging:

- Improved product quality

- Patriotic consumption trends

- Agile digital marketing

K-Beauty counters through premiumization and technological innovation:

- APR's Skin Booster medical devices (₩1.3 trillion projected 2023 revenue)

- Pharma Research's Lizuran collagen technology

- Market-specific product development (e.g., 50-shade foundation ranges for Europe)

Legacy Brand Transformations

Established players face divergent paths:

Amorepacific

- Successfully reduced China dependency from 40% to <20%

- Pivoting to US/Japan markets

- Rebranding heritage lines (Sulwhasoo)

LG Household & Health

- 20-year first operating loss in cosmetics division

- Slower China dependency reduction

- Strategic review underway

Investment Outlook

Institutional analysts suggest:

"Current corrections reflect technical adjustments rather than fundamental deterioration. Entry points may emerge for companies with:

- Diversified geographic footprints

- Medical-beauty convergence models

- ODM technological moats"

Key catalysts to monitor:

Short-term (Q4 2023)

- Tourism recovery data

- Black Friday sales performance

- U.S. tariff negotiations

Mid-term (2024)

- European market penetration metrics

- Medical device approval pipelines

- Premium brand development

The K-Beauty evolution continues—from mass-market phenomenon to technology-driven global premium player.